Nicole Hopkins’ opinion piece in the November 21, 2013 issue of the Wall Street Journal is headlined, “ObamaCare Forced Mom Into Medicaid“. Ms. Hopkins, a resident of Brooklyn, NY, describes her mother’s situation as a low-income resident of western Washington state and suggests that the opening of Medicaid to low-income adults such as her mother is actually a form of oppression that snuffs out personal dignity and systematizes “learned helplessness”. Granted, her mother is angry that she was not given the option to purchase a policy on the state marketplace, but the assumption that continuing to spend well over 25% of her income on a catastrophic, bare-bones insurance policy is a better use of her limited resources bears a closer look. It may be that in the long run, this change in the way her health care needs are financed will be recognized as one of those proverbial “blessings in disguise” about which we sometimes hear.

The Story In Brief

Ms. Hopkins’ mother is 52 years old. She is looking for regular work that would provide employer-sponsored health insurance but has been unable to find any. She works as a substitute para-educator in the local school district. Her current income is below the federal poverty line (FPL) — her daughter notes in the article that her mother has long known that she qualified for Medicaid (Washington Apple Health) in Washington state, though as an able-bodied adult without children under the age of 18 she might not actually have been able to get that coverage.

Mother has a long history of supporting herself and her children. She was easily able to purchase health insurance for the entire family from her income when the children were young. Once the children were grown, she tried a career change, becoming a licensed real estate agent. As many other self-employed people discovered during the Great Recession, paying clients proved too few and far between to cover expenses. In 2011 she gave up her license and began looking for other ways to support herself. (No unemployment benefits for the self-employed who don’t get enough clients.) Work as a substitute teacher was available and she took it. She is self-motivated, determined to make her own way in life, not asking for any hand-outs: a woman who lives out the American ideal of the self-sufficient, independent, “fully functioning member of society”.

For the past two years, she has purchased an insurance policy for $269 per month that covers catastrophic health care needs. Such policies typically have high deductibles, offer little access to regular medical care, don’t provide coverage for brand name prescriptions or services such as maternity or newborn care, and before the Affordable Care Act (ACA) could include annual and lifetime limits on claims payments made. For the coming year, the premium for a new policy that will be compliant with the ACA’s requirements will cost $415.20. If we assume Mother’s income is under $957.50 per month (FPL) since she has been income-qualified for help for the past couple of years, the premium she has been paying takes a minimum of 28% of her monthly income. The ACA deems premiums greater than 8-9.5% of monthly income to be unaffordable. The new premium, at over 43% of her income, is out of the question.

Going to the Marketplace

Washington is one of the 14 states that have set up their own insurance marketplace. The website is working reasonably well, as is typical of the sites set up by the individual states. Mother was able to create her account, enter her particular information, and find her options for health insurance. The shock came when she discovered that she was eligible for Medicaid and that no other policy outside of Washington Apple Health was open for her to purchase.

She was mortified. In her experience as a middle-class woman, accepting help from the larger community (i.e., federal and state governments) is shameful. The notion of a social safety-net that is available for everyone during times of need is hard to accept, especially when one is first confronted with the reality that he or she is truly experiencing a time of need. Since the belief system under which most Americans live, whether religious or not, is based on the Calvinist notion that our financial success or failure is a reflection of whether we are in good-standing with God or not, being poor is seen as reason for negative judgement from our fellow citizens.These judgements are not necessarily conscious, but having a low income or being “poor” leaves people stigmatized.

Certainly some people are poor because they have made unwise choices in their lives, but others have followed all the rules, done everything “right” and still been unable to move into a comfortable middle-class life. “Falling” into poverty from the middle-class is very hard to swallow.

How Could This Have Happened?

Ms. Hopkins notes that Mother was always able to provide insurance for herself and her children and blames the ACA for making insurance unaffordable now. This is a common and very understandable reaction. After all, what 52 year old woman needs maternity and newborn coverage? Those with children under 19 may need pediatric dental insurance, but still … And so the ACA’s Essential Health Benefits get blamed for the cost of insurance.

What most people outside of the insurance industry have not seen is the degree to which the price of health care and the price of health insurance have increased over the past 20-30 years at a much faster rate than inflation. Additionally, they don’t see the difference in premium that is based on age of the insured.

When Mother was younger, her insurance was much less expensive in real dollars and as a percent of family income. Additionally real income was higher. (Wages have not kept up with inflation over the years.) Policies all included high cost services such as maternity and newborn coverage. Most had reasonable deductibles and copayments, so families could get care as needed. As the cost of care skyrocketed, policies became more restrictive in terms of benefits in hopes of keeping premiums affordable in both the individual and small group markets.

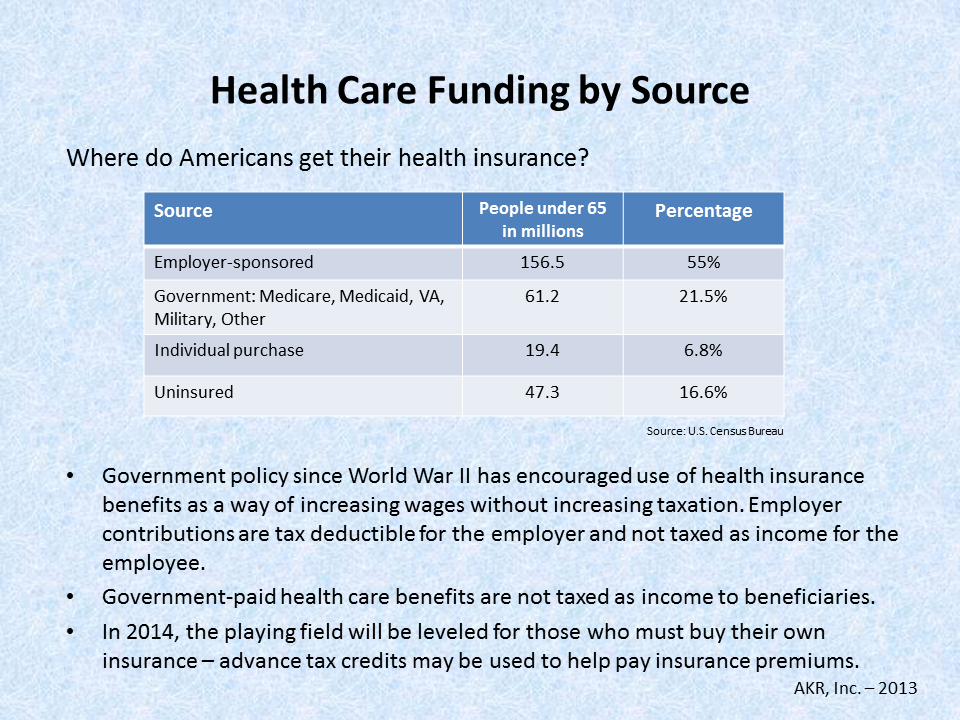

Most Americans got (and continue to get) their insurance through their employers or the federal government (Medicare, the Veterans Administration, and military benefits). The cost of their insurance has increased, but not as dramatically as that for individuals and small-business owners and employees. The risk pools for the latter are too small to provide the cost savings that can be obtained through larger pools.

In California, where I am licensed, in one region the cost of a minimum coverage policy similar to the catastrophic policy Mother has in Washington, but including all newly required benefits and deductible maximums, varies in price on the marketplace from a low of $194 per month at age 25 to a high of $580 per month at age 64. At age 45 it would cost $279 and by age 55 it jumps to $431. These prices seem similar to what Ms. Hopkins is reporting as the price for a new policy from her mother’s current insurer. Insurers must offer identical policies and identical pricing both on and off the marketplace exchanges, so the policy is likely to be similar to a minimum coverage or perhaps a Bronze policy on the Washington marketplace.

The addition of maternity and newborn coverage is not the primary issue in the increased cost of health insurance. When risk is spread more broadly, it costs less for each person who pays for a part of it. In California, all policies in the state have included such coverage since July 1, 2012 because the cost of not having this coverage in policies had become prohibitive. Women without maternity insurance (over 40% of insured California women who became pregnant) had been covered through Medi-Cal (our Medicaid program). Prices for policies have gone up with the coming of the ACA, but not because they include maternity and newborn care.

And What to Do …

The most important thing Ms. Hopkins and her mother can do at this moment is to stop and take a deep breath.

Sometimes great blessings hide in what seem to be awful realities. Mother is not more poor today than she was a week ago. In fact, as of January 1, 2014, she will be $269 per month richer, and she will have a comprehensive medical insurance program with little or no regular out-of-pocket cost. If Mother is unable to bring herself to use her Washington Apple Health coverage, she does not have to do so. But neither will she have to pay for a policy that does not actually protect her.

Will Mother choose to use her new health care options? That is not a question anyone else can answer. She is approaching an age (55-64) at which insurance premiums skyrocket and many Americans have found themselves priced out of the market. At the same time, she has reached the age at which screening tests for deadly diseases begin showing positive results and lives are saved by early interventions. Tests such as mammograms, PAP smears, bone density screening, and colonoscopies are typically ordered for people in their early 50s. These tests are not inexpensive. Prior to the ACA, patients often had to pay for them through their deductibles.

The ACA treats screening exams as preventive care and as such they are not subject to deductibles or copays. Health insurance policies pay for them in full. Medicaid treats them the same way. Mother will not be forced to submit to these exams, but she would be well-advised to get them. They save lives and prevent much suffering for individuals and their families.

What might Mother do with her new-found wealth? If Mother does not have a well-funded retirement portfolio and truly does have enough money to meet her monthly needs, perhaps she and Ms. Hopkins could look at ways to set aside the $269 per month into a savings or retirement plan. Alternatively, if she is not comfortable keeping the money herself, she could donate it to a charity of her choice. However, if she does not have money in a liquid savings account, she should hold on to it and build up her reserves for “rainy days” that might yet come.

When her fortunes turn around and she gets more work, higher paying work, or employer-sponsored health insurance, she can simply report to Washington Apple Health that she no longer needs their health plan. At 138% FPL, she will be able to go to the marketplace and purchase a policy for which she herself pays the premium. Unless her income is greater than 400% of FPL, she will be well advised to accept a bit more help in the form of cost sharing reductions and/or advanced premium tax credits (subsidies). But that’s another issue for another day. Until then, qualifying for Medicaid may turn out to be a huge blessing in disguise.

Did you like this? Share it:

There’s a new attempt to un-do the Affordable Care Act (ACA) going on in D.C. It’s disguised as an attempt to reform the law, but make no mistake, this proposed change will take us backward in time.

There’s a new attempt to un-do the Affordable Care Act (ACA) going on in D.C. It’s disguised as an attempt to reform the law, but make no mistake, this proposed change will take us backward in time.