Employer-sponsored Health Insurance

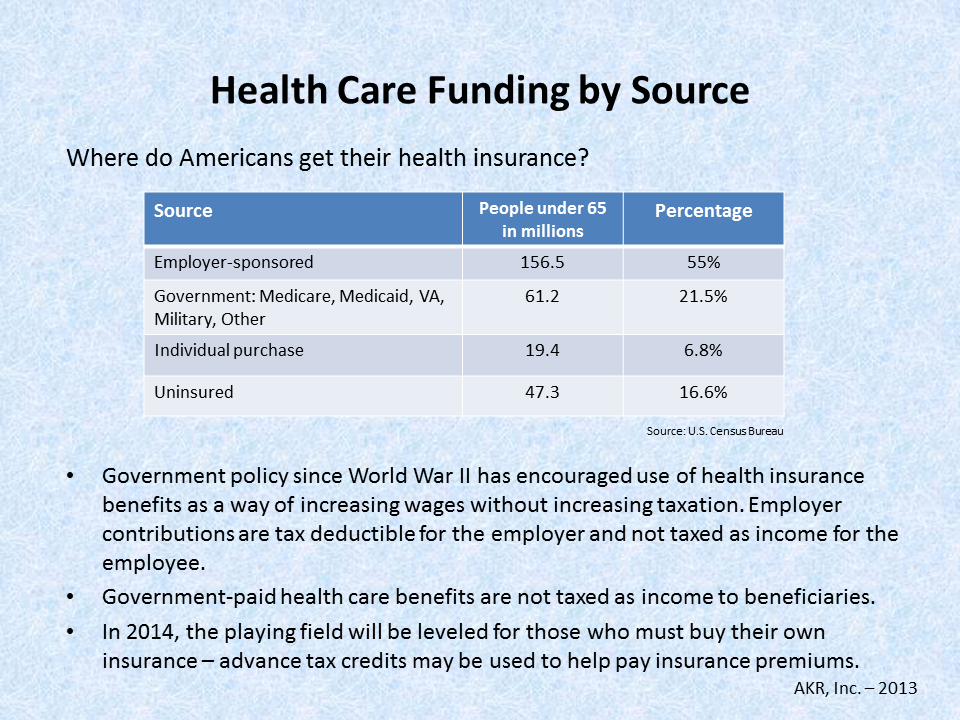

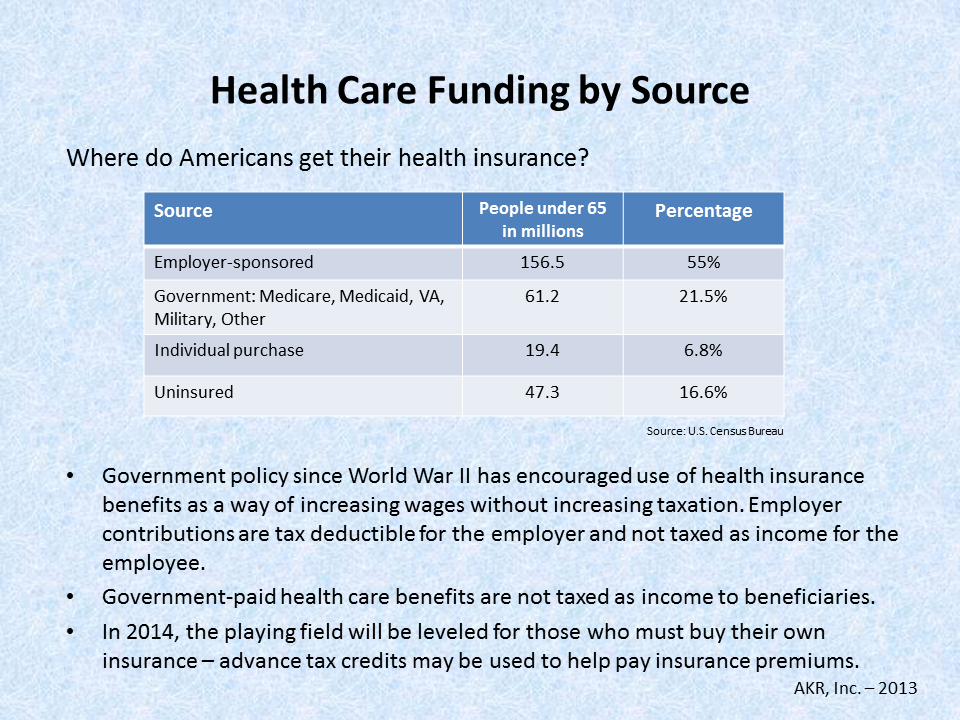

According to the U.S. Census Bureau, funding for health insurance in the United States has three major sources. The largest and perhaps least recognized source is employer-sponsored health insurance. According to Census Bureau estimates, in 2012 a majority of Americans (55%) got health insurance as a benefit from their employers. Though generally not seen as a subsidized form of insurance coverage, this insurance is funded using premium dollars that are deductible from the employer’s taxable income. The money paid by the employers for employee health insurance is not counted as taxable income paid to employees. Therefore, both employer and employee benefit from income tax provisions that support including health insurance as an employee benefit. Nevertheless, as a result of the rising cost of health care, a greater share of the out-of-pocket cost of health care has been shifted to employees and benefits have been restricted as employers have faced premium increases out-pacing inflation.

Government Funded Health Insurance

The federal government is the second major source of funding for health care. Federal funded care includes the Veterans Administration, Tri-Care, The Indian Health Service (Department of the Interior), Medicare, and Medicaid. Medicare is funded through a combination of payroll taxes on W-2 income and insurance premiums paid by beneficiaries. Medicaid is funded by a combination of state and federal taxes. The others are all paid from taxes collected and funds appropriated to specific government departments and agencies. An estimated 21.5% of Americans have government funded health care.

Individually Purchased Health Insurance

The final source of funding for health care is the individual insurance market. Approximately 6.8% of Americans buy their insurance directly from insurance companies. Prices on the individual market are generally higher than group policies because the risk pools are smaller. Additionally, individuals traditionally were charged more for having certain health conditions or based on gender. Insurers were allowed to charge women more for the same policy than men, for example.

Uninsured Individuals

An estimated 16.6% are uninsured. Those who are undocumented are not allowed to enroll in insurance policies, but the majority are American citizens by birth. These uninsured citizens include those who have a pre-existing health condition that led to their exclusion from insurance, those who are low income but don’t qualify for Medicaid because they are able-bodied and don’t have children under the age of 18, and those for whom insurance is simply too expensive because of their age, gender, or health condition.

The primary focus of the Affordable Care Act is to help the uninsured and underinsured get affordable coverage. Small business owners and employees will find help getting insurance, as will individuals who must purchase their own insurance. The law requires that all insurers offer 10 Essential Health Benefits in their policies as a way of ensuring that risk pools for higher cost conditions are large enough to make the coverage accessible to all who need it. The Affordable Care Act does not change Medicare benefits except that preventive services are now more affordable and the “donut hole” in the prescription benefits plans is being closed.

Graphics courtesy of Advanced Knowledge Resources, Inc.

Did you like this? Share it:

There’s a new attempt to un-do the Affordable Care Act (ACA) going on in D.C. It’s disguised as an attempt to reform the law, but make no mistake, this proposed change will take us backward in time.

There’s a new attempt to un-do the Affordable Care Act (ACA) going on in D.C. It’s disguised as an attempt to reform the law, but make no mistake, this proposed change will take us backward in time.